#3 Risks or Cannibalism?

We should ask more frequently the question 'risks to what'?

Hi all,

In the aftermath of a week that marked 2023 as the warmest year on record, coupled with ongoing conflicts and a fresh escalation in the Red Sea, maintaining a positive outlook is undeniably challenging. It appears that this week has propelled us further into the complex landscape of the Polycrisis.

Yet, amidst these challenges, there has been substantial discourse on risks, notably evident in the World Economic Forum's Global Risk Report.

While it is logical to discuss risks in the current climate, in this edition of Tipping Point Economics I want to pose a critical question: Is it appropriate to discuss risks when they evolve into existential threats? Risks to what exactly? Risks to a system or the risk of the system, that is the root cause of the prevailing issues? Are we not cannibalizing the system itself, and should that not be the discussion? A more impactful strategy would then be to advocate for systemic change. After all, the root cause of the current risks is the economy itself — the fundamental 'what' in this equation.

To conclude this edition, you'll find some links and highlights from the past week.

Please stay in the loop by subscribing directly or joining us on Substack.

Enjoy the read!

It is risky to only talk about risks.

A systems crisis that becomes more profound. That is my conclusion after reading the Global Risk Report this week. And because of that, I have a problem with continuously framing existential threats as ‘risks’. Risks to what? Maybe the system in itself is the most fundamental risk. Risks will remain if solutions stay shallow and our economic system is not drastically adapted.

Risks

You still encounter these narrowly economic-focused risk assessments from major banks.

Primarily, they revolve around geopolitical risks influencing economic development. As the Majority of the world’s population prepares to cast their votes for national leaders in the next 12 months, the question arises: does it truly matter? Despite 2023 being a remarkable year for risk assets amid conflicts in Europe and the Middle East and escalating tensions between the US and China, one might be tempted to dismiss its significance. If stocks can surge under such conditions, why bother?

Nevertheless, investors remain deeply invested and dedicate considerable time to these concerns. As an intriguing gauge, the emerging markets team at Citi conducted a client poll to identify the top worries for the upcoming year. Summarised here, the results revealed that geopolitics in general, and the US election in particular, took precedence over more conventional concerns like inflation, growth, and monetary policy. For me, this is a narrow, very shallow focus on where we are as a society. The economy is only a part of it. And framing risks only towards the economy is, well, not particularly useful.

Because the economy is part of the society and society is embedded in the biophysical reality. As I explained the idea of polycrisis in a previous post, the multifaceted crisis is essentially an interlinked ecosystem-social system-economic system interrelated crisis. This is complex and interrelated (see below), with events (risks) being part of the puzzle.

As I said before, we can not expect it to fade away quickly. Reading the just-published Global Risk Report report from the World Economic Forum confirms this notion: risks to the global community are increasing and are becoming more existential.

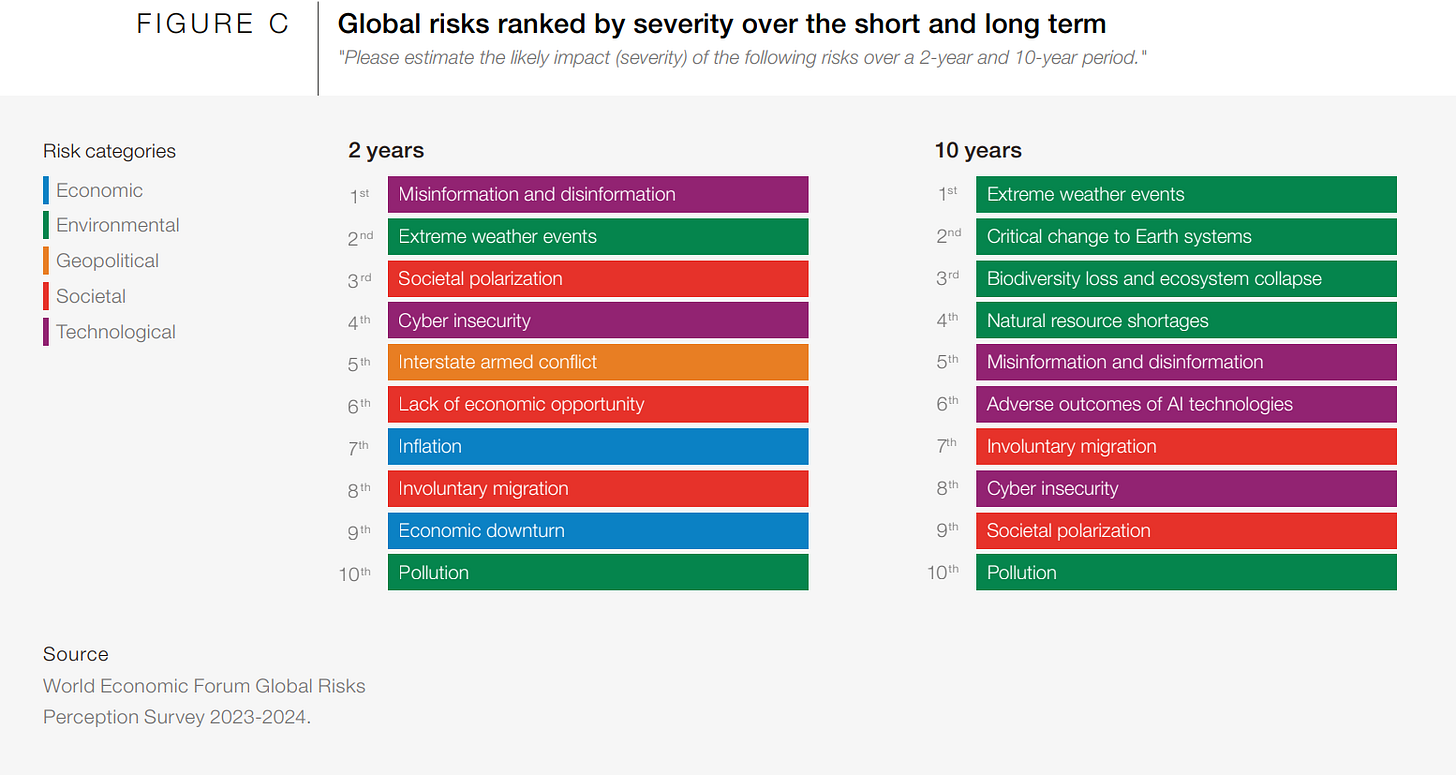

Many commentators have shared their opinions on the topic, using the chart provided (see below) to draw conclusions. Some have emphasized the short-term risks associated with the success of generative AI and its combination with rising populism and upcoming elections, specifically the risk of misinformation and disinformation. Others have focused on the long-term picture, highlighting the environmental risks that dominate the conversation.

Structural forces

I find the WEF's discussion of the structural forces that have the greatest material impact on the global risk landscape more intriguing. It goes closer to root cause analysis. Their four forces:

Technological acceleration The development pathways of emerging technologies. A subset of key technologies, including general-purpose AI, is anticipated to experience significant, accelerated development over the next ten years. Multiple trajectories may arise due to the sheer scope of frontier development and general-purpose applications.

Climate change encompasses the range of possible trajectories of global warming and consequences to Earth systems. Climate change is characterized as a systemic shift in this year’s analysis because the threshold of 1.5°C above pre-industrial temperatures, specified in the 2015 Paris Agreement, is anticipated to be crossed by the early to mid-2030s (or faster). However, global warming pathways will still be influenced by the speed at which decarbonization takes place and the deployment of climate solutions. Degradation of environmental systems could also accelerate estimated trajectories to the extent that they “naturally” contribute to global warming and related effects (such as the reversal of carbon sinks)

Geostrategic shifts refer to evolving sources and concentration of geopolitical power. This, in turn, influences the alignment of the geopolitical order, impacting related alliances and dynamics, as well as the offensive and defensive projection of soft and hard power over the next decade. Economic power is becoming more diffuse, for instance, reflecting changes in currency dependencies, sources of energy, available capital and size of consumer markets. Economic and military power concentrations are also highly related to technological and resource assets.

Demographic bifurcation entails alterations in the size, growth, and composition of populations globally. The demographic divide is progressively widening, with a polarised expansion at both the upper and lower ends of population pyramids, as well as between countries and regions. This divergence will significantly impact interconnected socioeconomic and political systems.

These underlying structural forces (I would widen the one on climate to cover all nine ecosystems as defined by the planetary boundaries) serve as the determinants of risks. When examining the risk lists in the Global Risk Report over the long term, it becomes evident that the most crucial or substantial risks are primarily propelled by emerging issues and topics prevalent during the survey. Consequently, the risk list, particularly concerning two-year risks, may not offer highly informative insights; the focal point lies more on the structural forces steering them.

These structural forces do not lead to a positive picture for humanity going forward:

“As constant upheaval becomes the norm, decades of investment in human development – and human resilience – are slowly being chipped away, potentially leaving even comparatively strong states and individuals vulnerable to rapid shocks from novel and resurgent sources. The impacts of extreme weather may deplete available economic resources to mitigate and adapt to climate change. Increasing vulnerabilities, brought about by resource stress, conflict and increasing polarization, could expose societies and whole economies to crime and corruption. Exponential technology growth may leave the next generation without a clear path to improve human potential, security and wellbeing.” (WEF, 2024, page 32)

Shifting risks

Taking a longer-run perspective, based on the Global Risk Reports, it is clear that risks for the global community have shifted (see figure). Economic risks dominated in the 00s; currently, environmental risks dominate.

Twenty years ago, managing risks from within the system was relatively easy. You could easily assert that the economic system itself was not at risk; it was foremost managing the negative consequences of it.

This is impossible to state now. The report discusses different types of tipping points, such as ecological tipping points that occur when certain levels of environmental degradation are crossed, social tipping points that lead to the destabilisation of society due to polarisation and other social developments, and technology tipping points that may arise if generative AI becomes so powerful that it threatens nation-states or even humanity. The overall tone of the report is quite gloomy.

The agenda to counter this (in chapter 3 of the report) is rather disappointing:

“Localized strategies, leveraging investment and regulation, are critical for reducing the impact of global risks, and both the public and private sector can play a key role in extending benefits to all. Through prioritizing the future and focusing on breakthrough research and development, the efforts of single entities can make the world a safer place. The actions of individual citizens, companies and countries – while perhaps insignificant on their own – can move the needle on global risk reduction if they reach a critical mass. Finally, cross-border coordination remains the only viable pathway for the most critical risks to human security and prosperity.”

A within-system approach to save humanity from existential threats. I have seen it better.

Cannibal Capitalism - Risk to what?

Because that is what is missing: a fundamental root cause analysis of the risk. The real diagnosis is not that we have a risk to our system: our (economic) system is an existential threat. Cannibal Capitalism, to use the title of the book by Nancy Fraser.

If the system itself is the issue, superficial solutions offer little assistance. Only radical transformative change can provide a meaningful answer. In this context, research, education, and collaboration, while valuable, may not suffice. What's imperative is an exchange of worldviews and a critical examination of paradigms, including the notion that economies must invariably experience perpetual growth and that capitalism is universally beneficial (certain forms may be, but the overall spectrum of capitalism currently suggests otherwise).

A pivotal moment would occur if those gathered in Davos engage in discussions about the root causes of risks: the operational mechanisms of contemporary economies. The relentless pursuit of growth for its own sake, the commodification of everything for profit without sufficient regulation to mitigate adverse impacts on humanity and nature—these are the critical issues. Let's await the discussions in the upcoming week.

In the news

A new Nature Climate Change article stresses that addressing inequality is pivotal in propelling the world towards Net-Zero, emphasizing that inequality limits the feasible adoption of low-carbon behaviors

Where has all the honey gone?This study shows for the US over the last decade that certain factors result in a declining number of bees: Climate change, Soil productivity, Land use change, Annual weather anomalies

The global economy is on track for its worst half-decade growth since 30 year: Global growth is set to slow further this year amid tight monetary policy, restrictive financial conditions, and feeble global trade and investment. Downside risks include an escalation of the recent conflict in the Middle East, financial stress, persistent inflation, trade fragmentation, and climate-related disasters.

Scientists outline a bold solution to climate change, biodiversity loss, social injustice: a proposal for a new standard pathway, particularly in climate scenarios—a sort of post-growth approach(see also my Linkedin comments).

Again someone arguing that exponential growth is not the problem and my

Extremely thorough article Translating Earth system boundaries for cities and businesses: Robust, transparent and fair cross-scale translation methods are essential to help navigate through the multiple steps of scientific and normative judgements in translation, with clear awareness of associated assumptions, bias and uncertainties.

That’s all for this week.

Take care.

Hans

Hello Hans,

I've only read a couple of your posts, having recently found you via Twitter. In the late '90s I was a co-moderator of the Ecological Economics list of Communications for a Sustainable Future which was eventually closed by its sponsor U of Colorado. My degree was in Philosophy from NYU, but I dropped out of grad school to earn a living. Between the mid 70's and '89 I was a derivatives expert at EF Hutton, Merrill Lynch (equities), an Ass't Dir. at Merrill's International Bank in FX Options, and at Refco (commodity house & primary dealer for some years). (retired at 45 to organic gardening, forestry, wild mushroom foraging, recreational hiking & x-c skiing, and self study.

Many system scientists agree that the quadrupling of human numbers in the lifespan of living members constitutes "Plague Phase" for a large mammal. These have always ended in population declines, and in our case drastic changes are likely to 'civilization' as we know it.

Some economists have come to see our economy as an energy system which is at risk of involuntary degrowth. A good site by Tim Morgan, former chief strategist for Tullett Prebon, is:

https://surplusenergyeconomics.wordpress.com

Emphasizing these two major factors along with the other deleterious drivers of system (incl. nature) deterioration and risk seems appropriate.

Cheers on the Downslope,

Steve

Steven B Kurtz

Amherst MA